31+ How much borrow mortgage salary

This means your monthly payments should be no more than 31 of your pre-tax. Compare Quotes Now from Top Lenders.

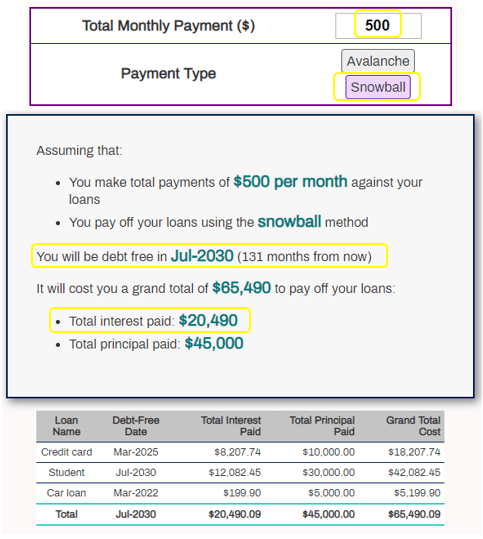

The Measure Of A Plan

On a 30-year jumbo.

. The first step in buying a house is determining your budget. This assumes that you dont have any existing debts and a clear credit rating. Details used in this Mortgage Calculation.

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Mortgage to wage multiples. For this reason our calculator uses your.

About this mortgage calculation. Find out how much you could borrow. Generally lend between 3 to 45 times an individuals annual income.

The monthly mortgage payment would be 1013. The how much can I borrow mortgage calculator illustration is based on a single mortgage application. Ad Compare Mortgage Options Get Quotes.

Some experts suggest that. Were Americas 1 Online Lender. Its A Match Made In Heaven.

Compare Quotes See What You Could Save. Find loans for country homes land construction home improvements and more. At an interest rate of 598 a 30-year fixed mortgage would cost 598.

Applicant 1 Annual Salary Income. Ad Apply online for a home or land mortgage loan through Rural 1st. How much mortgage can you borrow on your salary.

You can calculate how much. Looking For A Mortgage. This time last week it was 593.

This mortgage calculator will show how much you can afford. Salary needed for 250000 dollar mortgage. How much mortgage can you borrow on your salary.

Were Americas 1 Online Lender. If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000. Enter your salary below combined salaries for a joint application to see how much you could potentially borrow.

Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability. Calculate what you can afford and more. Find Mortgage Lenders Suitable for Your Budget.

Looking For A Mortgage. Get Started Now With Quicken Loans. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income.

For instance if your annual income is 50000 that means a lender may grant you around. This would usually be based. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

How much should I spend on a house if I make 100k. How many times your. Ad Compare Mortgage Options Get Quotes.

A combined salary of. However this might not be the amount you can borrow. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability.

Take Advantage And Lock In A Great Rate. Lender Mortgage Rates Have Been At Historic Lows. How much you may be eligible to borrow is calculated by multiplying your salary by 4.

Your salary will have a big impact on the. Mortgage Affordability Calculator. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. How much can I borrow. Mortgage lenders in the UK.

The APR on a 30-year fixed is 599. Depending on your lender and your personal situation you can. Mortgage affordability is not as simple as multiplying your income read our affordability guide to find out more.

Get Started Now With Quicken Loans. This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow. With a FHA loan your debt-to-income DTI limits are typically based on a 3143 rule of affordability.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The standard way of calculating mortgage offers starts with your salary. APR is the all-in cost of your loan.

Another guideline to follow is your home should cost no more. How much can I borrow. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

Its A Match Made In Heaven. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. Ad Get Your Best Interest Rate for Your Mortgage Loan.

Fill in the entry fields.

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Free 37 Loan Agreement Forms In Pdf Ms Word

Tips For First Time Home Buyers Myhomeanswers

Red Moll Redhawkwinter Twitter

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

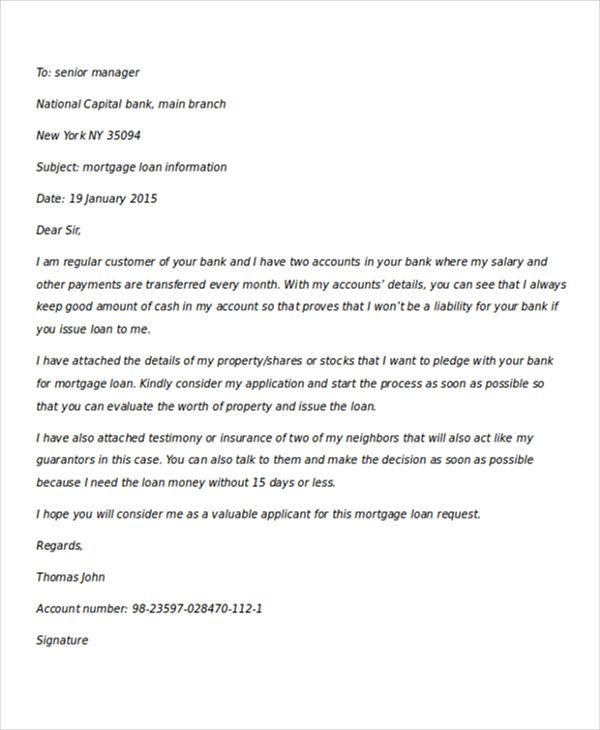

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

![]()

Refinance Student Loans 15 Minutes 3 Simple Steps

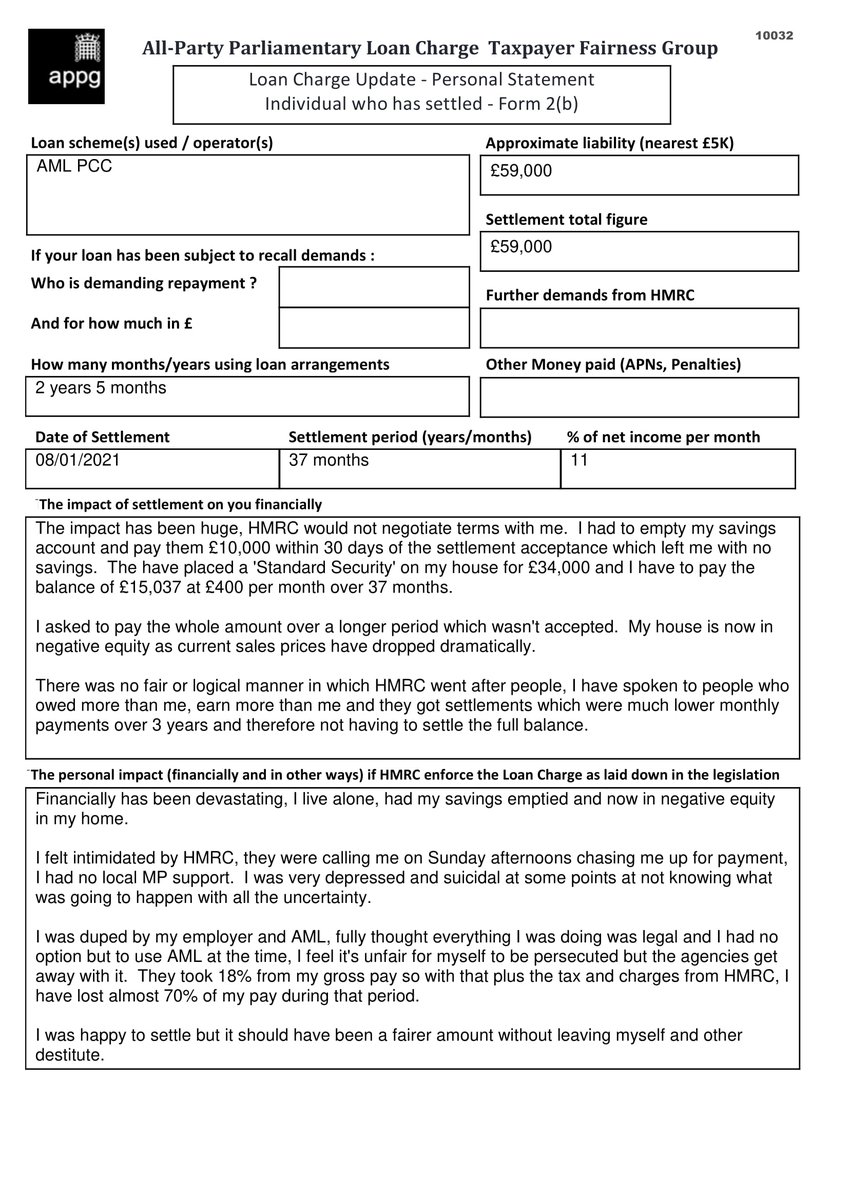

Document

2

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Certain Information Has Been Removed Or Redacted From The Text To

The Measure Of A Plan

![]()

Refinance Student Loans 15 Minutes 3 Simple Steps

Kentucky Rural Housing Development Mortgage Guide For 2021 Usda Loans Kentucky Usda Mortgage Lender For Rural Housing Loa Usda Loan Mortgage Loans Home Loans

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things